And the Weak Suffer What They Must ~ Yanis Varoufakis

Must-read blogs

- Casinos Not On Gamstop

- Casino Con Bonus Di Benvenuto

- UK Online Casinos Not On Gamstop

- Migliori Bookmakers Non Aams

- Gambling Sites Not On Gamstop

- Non Gamstop Casinos UK

- Non Gamstop Casino UK

- Slots Not On Gamstop

- Best Non Gamstop Casinos

- Sites Not On Gamstop

- Non Gamstop Casino

- Sites Not On Gamstop

- Slots Not On Gamstop

- UK Casino Not On Gamstop

- Casino Non Aams

- Best UK Online Casino Sites

- Sites Not On Gamstop

- Casino En Ligne Fiable

- Non Gamstop Casino UK

- Non Gamstop Casino

- Non Gamstop Casinos

- Non Gamstop Casino

- Migliori Casino Online Italiani

- Best Betting Sites Not On Gamstop

- Meilleur Casino Crypto

- Sites De Paris Sportifs Belgique

- Casino En Ligne Fiable

- найкращі крипто казино

- Meilleur Casino Sans Kyc

- Casino Cresus

- Bonus Gratuit Sans Dépôt

- Casino Senza KYC

- Meilleur Casino En Ligne

- Migliori Crypto Casino

- Meilleur Site Casino En Ligne Belgique

- Casino En Ligne Argent Réel

- Casino En Ligne Français

- Meilleur Casino En Ligne France

- Migliori Siti Poker Online

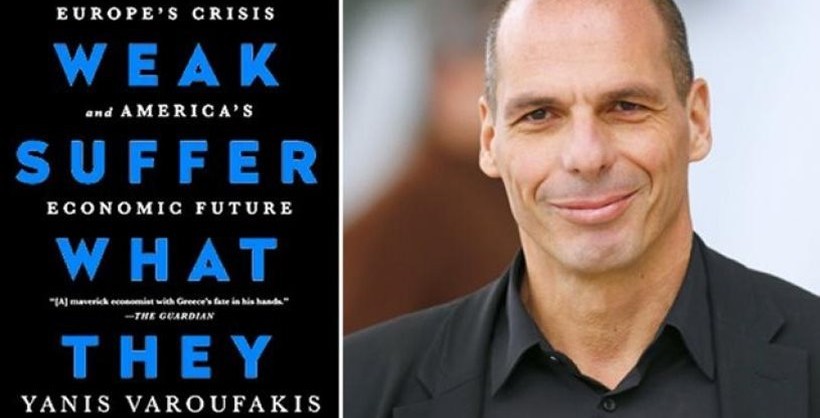

Yanis Varoufakis, the fiery new Greek Finance Minister, is a Greek Economist and prominent critic of modern Global Bankster Capitalism. His new book,

Yanis Varoufakis, the fiery new Greek Finance Minister, is a Greek Economist and prominent critic of modern Global Bankster Capitalism. His new book,